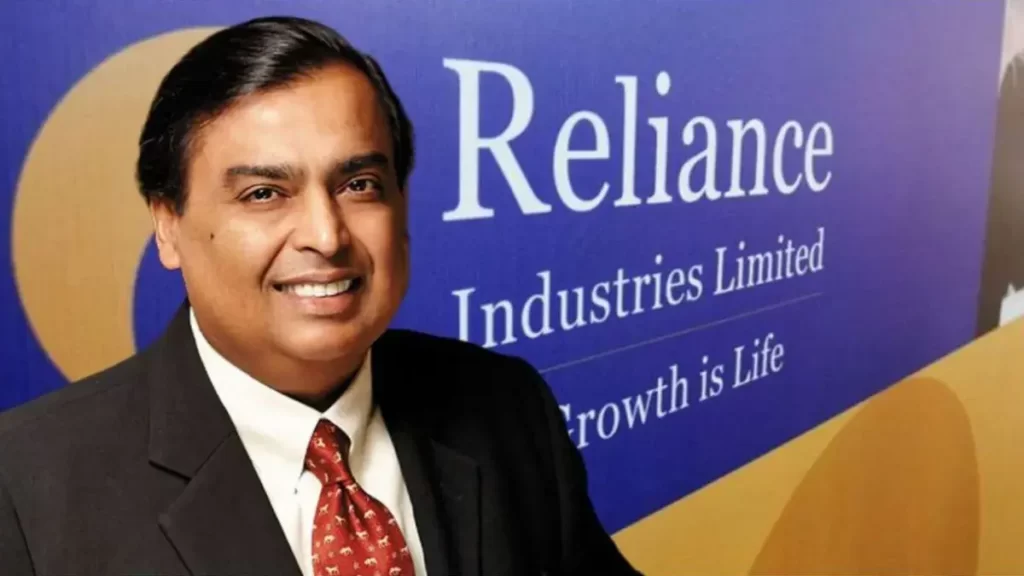

Reliance JioCinema Secures Exclusive Deal with Pokemon for Extensive Children’s Content Offering in India

Reliance JioCinema, the entertainment division of India’s Reliance, has entered into an agreement with The Pokemon Company to feature children’s shows and movies on its platform, sources familiar with the deal revealed. This move is part of Reliance’s strategy to enhance its content library in the face of increasing competition from streaming rivals like Walt …