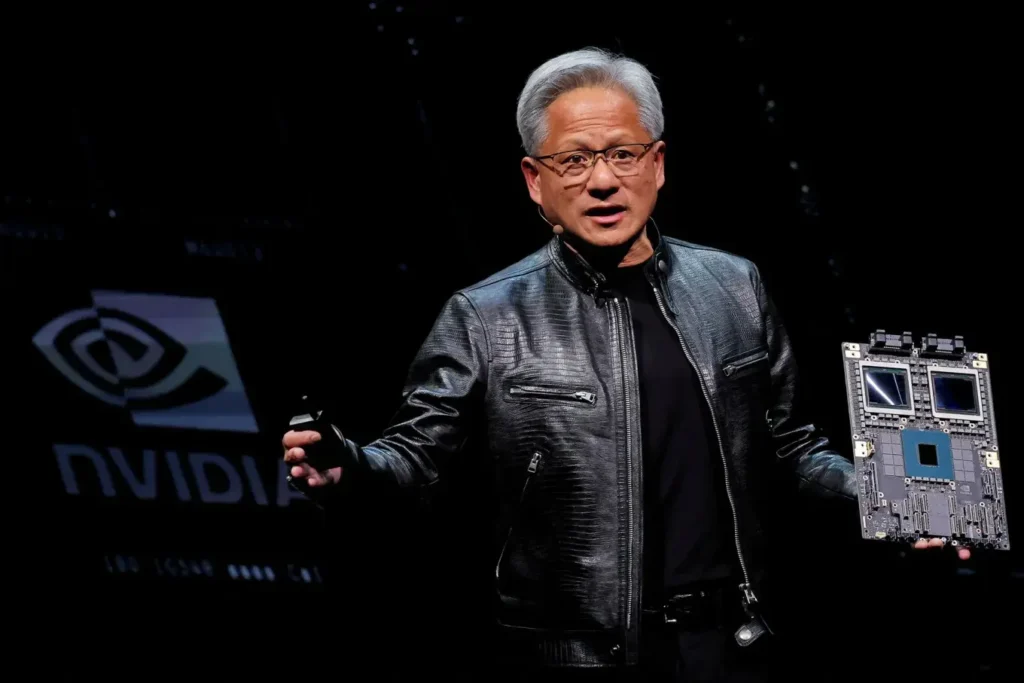

Digital Colleagues Incoming: Nvidia CEO Says AI ‘Employees’ Will Work Alongside Humans, IT to Become HR for Agentic AI

Nvidia CEO Jensen Huang has offered a bold vision of the corporate workforce’s future — one where digital employees powered by artificial intelligence (AI) will work hand-in-hand with humans. These AI “agents,” he says, will not only perform professional roles but also undergo formal hiring and onboarding processes to learn company values, culture, and workflows. Huang believes this emerging “agentic AI workforce” could create a trillion-dollar market opportunity. In a recent conversation with Citadel Securities, Huang said he expects future enterprises to employ digital nurses, lawyers, accountants, and marketers — some licensed from AI developers, others trained in-house. “You’ll hire some and license some, depending on their expertise,” he explained. “The future workforce will blend humans with digital humans.” Huang emphasized that these AI agents will need structured orientation and integration, much like their human counterparts. “I tell my CIO that our IT department will one day be the HR department for agentic AI,” he remarked. “Our digital employees will collaborate with our biological ones — that’s the future shape of our company.” These AI “workers” could come from multiple platforms, including OpenAI, Harvey, OpenEvidence, Cursor, Replit, and Lovable. Some may be internally developed — Nvidia already employs more AI cybersecurity agents than human experts to protect its data and systems. The conversation around agentic AI — self-directed, task-performing digital entities — is gaining traction across the tech industry. Salesforce CEO Marc Benioff said at the World Economic Forum in Davos that the current generation of executives will likely be the last to lead all-human workforces. “From now on, leaders will manage both human and digital employees,” Benioff said. Similarly, Anthropic CEO Dario Amodei predicted that by 2026 or 2027, AI systems will surpass humans “in almost all domains,” underscoring the rapid pace at which artificial intelligence is evolving toward autonomy and workplace integration. Source: TOI