ArdorComm Media News Network

September 8, 2025

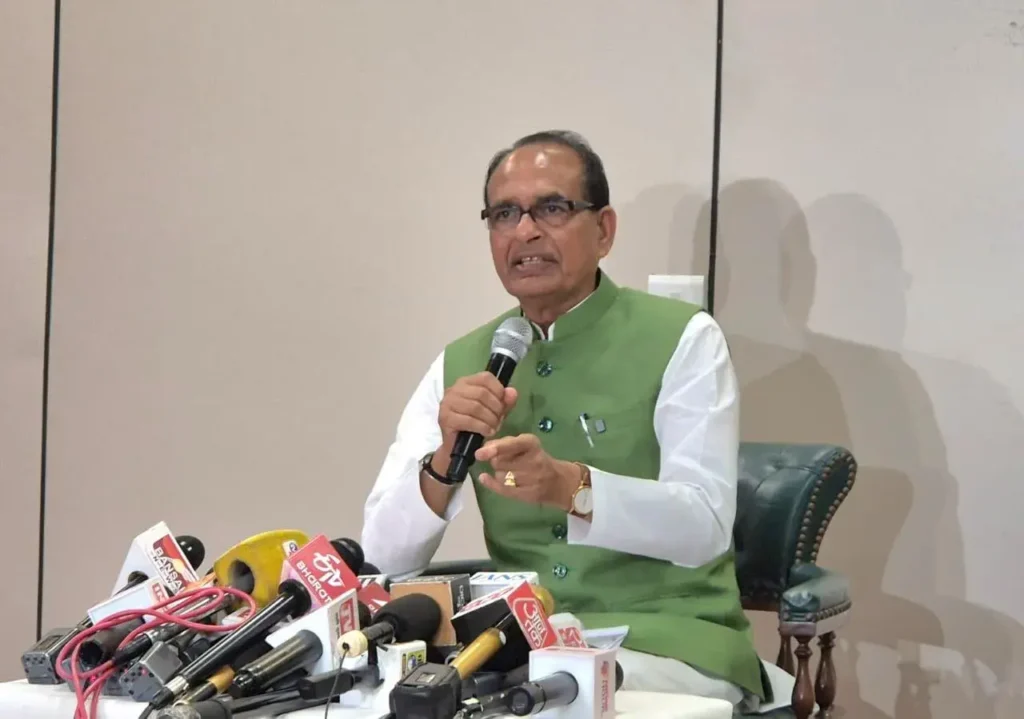

Union Agriculture and Rural Development Minister Shivraj Singh Chouhan has said that the recently announced GST reforms will significantly reduce the cost of farming, directly benefiting small and medium farmers across India. Addressing a press conference in Bhopal, he described the changes as a “boon for farmers and rural India.”

Major Relief for Agriculture and Dairy

The Minister highlighted that the reduction of GST on bio-pesticides and micro-nutrients will encourage farmers to adopt organic and natural farming over chemical fertilizers. Additionally, the complete exemption of GST on milk and cheese is expected to boost the dairy sector, benefiting consumers, dairy farmers, cattle rearers, and producers. GST cuts on butter, ghee, and milk cans will further strengthen the sector.

Lower Costs for Farming Equipment

According to Shri Chouhan, GST on agricultural machinery — including tractors, harvesters, power tillers, threshers, paddy planters, and seed drills — has been slashed from 18% to 5%, bringing substantial savings.

- A 35 HP tractor will now cost around ₹6.09 lakh, saving farmers nearly ₹41,000.

- A 45 HP tractor will be cheaper by ₹45,000, while a 75 HP tractor will cost ₹63,000 less.

- Equipment such as multi-crop threshers, paddy planters, power weeders, mulchers, and seed-cum-fertilizer drills will also see price reductions ranging between ₹5,000 and ₹32,000.

“These reforms mean that a farmer investing in essential machinery can save anywhere between ₹25,000 and ₹63,000,” Chouhan emphasized.

Boost for Allied Sectors and Women Entrepreneurs

The Minister also pointed out that allied activities such as animal husbandry, poultry, fisheries, beekeeping, and agro-forestry will gain momentum under the new GST regime. He praised the work of women self-help groups engaged in handicrafts, milk products, and rural enterprises, saying the exemptions would further empower initiatives like ‘Lakhpati Didi’, enhancing women’s income in villages.

Support for Organic Farming and Food Processing

GST reduction on fertilizer raw materials such as ammonia, sulphuric acid, and nitric acid (from 18% to 5%) is expected to lower fertilizer costs, making organic and natural farming more affordable. Similarly, reduced GST on processed fruits, vegetables, fish, honey, and dry fruits will support value addition and food processing industries, ensuring farmers get higher returns.

Rural Infrastructure and Energy Savings

Chouhan added that GST cuts on cement, iron, drip irrigation systems, and renewable energy equipment will lower the cost of rural housing, infrastructure projects, and irrigation, aligning with government schemes like Pradhan Mantri Awas Yojana. This, he said, will improve both living standards and productivity in rural India.

Strengthening the Rural Economy

“These GST reforms are more than just tax cuts — they represent a next-generation reform that will make agriculture profitable, promote allied farming, and empower women entrepreneurs,” the Minister said. He added that lower costs and rising demand would inject more money into the economy, ultimately boosting rural prosperity.

Expressing gratitude to Prime Minister Narendra Modi and the Finance Ministry, Chouhan concluded: “Our goal is clear — to reduce production costs, increase output, and ensure higher profits for farmers. These GST reforms will change the face of Indian agriculture.”

Source: PIB