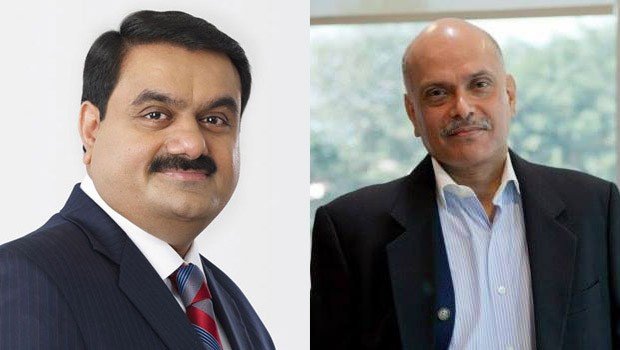

Adani Group Surpasses Mukesh Ambani’s RIL in 2024 M&A Deal Value

The Adani Group outpaced Mukesh Ambani-led Reliance Industries (RIL) in terms of merger and acquisition (M&A) deal value in 2024. The group secured deals worth $6.32 billion, significantly higher than Reliance Industries’ $3.14 billion, reaffirming its competitive edge in the M&A arena. This marks a reversal from 2023 when Reliance Industries led Indian conglomerates in M&A activity, with deals totaling $8.77 billion, while Adani Group’s deals amounted to just $1.73 billion. Despite the shifting dynamics, the Adani and Ambani groups continue to dominate the M&A landscape, regularly trading the top positions since the onset of the pandemic. Meanwhile, the JSW and Tata groups have also remained active in mergers and acquisitions, focusing on capacity expansion. The collective value of M&A deals by listed entities of India’s top five conglomerates accounted for 15.3% of the total deal value last year, reflecting their significant role in shaping the country’s corporate landscape. This trend highlights the intensifying competition between India’s top industrial giants as they strategically expand their influence through acquisitions. Source: business standard Photo Credit: business standard

Adani Group Surpasses Mukesh Ambani’s RIL in 2024 M&A Deal Value Read More »