India Considering Lowering Personal Tax Rates to Boost Consumption

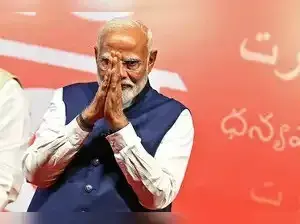

The Indian government is contemplating lowering personal tax rates for certain categories of individuals in the upcoming Budget 2024, potentially boosting consumption in Asia’s third-largest economy. This plan might be announced in July when Prime Minister Narendra Modi’s government presents its first federal budget after the Bharatiya Janata Party (BJP) failed to secure a majority …

India Considering Lowering Personal Tax Rates to Boost Consumption Read More »