ArdorComm News Network

February 1, 2023

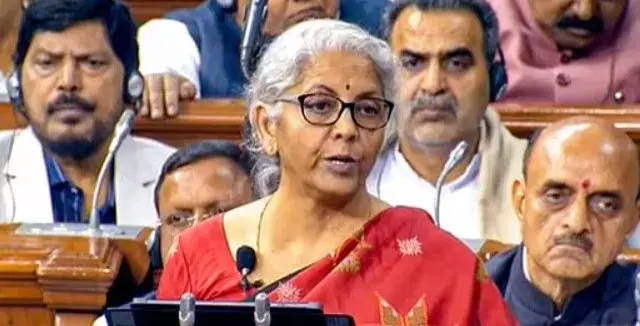

Nirmala Sitharaman, the finance minister, began the presentation of the last full budget of the Modi government with the statement “This is the first Budget of Amrit Kaal.” According to the FM, the Indian economy is recognized as a bright spot worldwide. India’s growth in the current fiscal year was the highest among major economies at 7%. Sitharaman stated in her budget address that the Indian economy is on the right track and is poised for a bright future.

She said that the Budget adopts the following seven priorities. They complement each other and act as the ‘Saptarishi’ guiding us through the Amrit Kaal.

1) Inclusive Development

2) Reaching the Last Mile

3) Infrastructure and Investment

4) Unleashing the Potential

5) Green Growth

6) Youth Power

7) Financial Sector

The per capita income has climbed to Rs 1.97 lakh. During the same period, India’s GDP increased from 10th to 5th largest in the world, according to Sitharaman’s speech during the Union Budget.

The introduction of Budget 2023 coincides with the crippling slowdown and potential recession that affect the world’s major advanced economies.

For the first time ever, Indian Railways has received a capital outlay of Rs. 2.40 lakh crore. According to Sitharaman, this is the railways’ highest capital outlay.

Nirmala Sitharaman, disclosed a significant increase in capital expenditure. The amount allocated for capital expenditures has increased by 33% to Rs 10 lakh crore in the Union Budget. This equates to 3.3% of the GDP. The FM also disclosed a significant expansion of the PM Awaas Yojana. Sithraman mentioned the continuance of the food security programme for another year in her statement on the budget. She also announced actions for agri startups, fisheries, and launched a programme for primitive, vulnerable tribal groups.

Major announcements for Income Tax payers:

- No changes in the old tax regime

- New tax regime to become the default tax regime

- No tax on income up to Rs 7.5 lakh a year in new tax regime

- Govt proposes to reduce highest surcharge rate from 37% to 25% in new tax regime

New slabs under new tax regimes

Rs 0-3 lakhs: Nil

Rs 3-6 lakhs: 5%

Rs 6-9 lakhs: 10%

Rs 9-12 lakhs: 15%

Rs 12-15 lakhs: 20%

Rs Over 15 lakhs: 30%

- Govt proposes to cap deductions from capital gains on investments in residential houses to Rs 10 crore

- An individual with annual income of Rs 9 lakh will have to pay only Rs 45,000 in taxes: FM Sitharaman

- Income of Rs 15 lakh will fetch Rs 1.5 lakh tax, down from Rs 1.87 lakh

- A Rs 50,000 standard deduction to taxpayers has been introduced under the new regime

- Payment received from Agniveer Corpus Fund by Agniveers to be exempted

- For online games, govt proposes to provide for TDS and taxability on net winnings at the time of withdrawal or at the end of fiscal

- Fully imported luxury cars and EVs to cost more as govt raises custom duty from 60% to 70% in Budget.

- Tax exemption on leave encashment on retirement of non-government salaried employees hiked to Rs 25 lakh from Rs 3 lakh